Forex Head and Shoulders Pattern Explained: Key Tips for Successful Trading

The Head and Shoulders pattern is considered one of the most important and widely used formations in technical analysis. It is commonly applied in the forex and cryptocurrency markets and enjoys strong popularity among traders. The market typically reacts to the formation of this pattern, making it a trusted indicator in technical analysis. In this article, we aim to introduce and explain this pattern—a simple, accessible, and yet highly profitable setup.

The Head and Shoulders pattern consists of two shoulders and a head. It usually forms at the end of a trend and signals a potential market structure break and a shift in direction. When correctly identified, this pattern can provide traders with valuable opportunities to capitalize on trend reversals and make more successful trades.

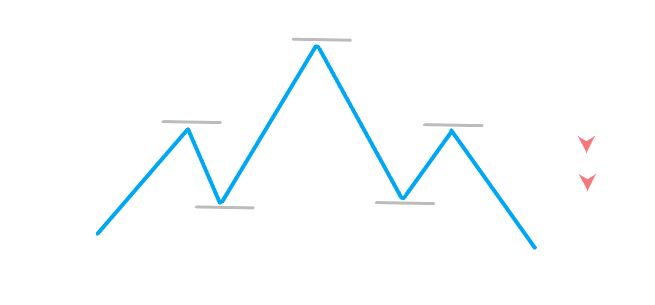

Descending head and shoulders pattern

In this pattern, the left shoulder forms first, followed by the head, which is the largest part of the pattern. Finally, the right shoulder forms, usually similar in size to the left shoulder. Traders use this pattern to enter sell positions and typically do so after the formation of the right shoulder or the breakout of the neckline.

Look at the picture above. The pattern shown is the Head and Shoulders pattern. The left peak is called the first shoulder, the middle peak is the head, and the right peak is the second shoulder. This formation is widely recognized as the Head and Shoulders pattern.

Consider the following example

Photo by TradingView

In the photo above, you can see a very clear and good example of a descending Head and Shoulders pattern. You could enter a sell position after confirming the formation of the second shoulder or the breakout of the neckline and profit from the price decline.

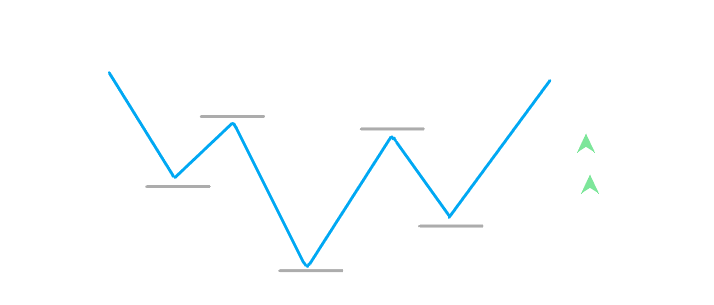

Ascending head and shoulder pattern

The second pattern is the ascending Head and Shoulders, which is suitable for buy positions. This pattern allows traders to enter buy positions at optimal points, aligning with market buyers and upward momentum. After the formation of the second shoulder, the market typically shifts into an upward trend. Many traders rely on this pattern to anticipate potential price increases and capitalize on bullish movements.

Pay attention to this ascending Head and Shoulders pattern, which consists of two shoulders and a head—the largest part of the pattern. In this pattern, you can enter a position either when the second shoulder forms or when the neckline breaks.

Consider the following example

Photo by TradingView

In the photo above, you can see a very clear example of an ascending Head and Shoulders pattern. In this example, you should enter a buy position after the formation of the second shoulder or after the breakout of the neckline to make a profit. This pattern is recognized as a strong signal for the beginning of an upward market trend, and traders often use it to identify buying opportunities.

Thanks for your time and enjoyment of this article.