Trade Balance Indicator in Forex: How It Affects Currency Prices and Market Trends

In fundamental analysis, economic indicators are very important. They have an impact on the Forex market. Today we are going to learn about one of the most important economic indicators in the Forex market, the Trade Balance. You can check the most important fundamental indicators and news on the Forex Factory website. This website displays all the important news and economic indicators.

Every country in the world with an active economy engages in both imports and exports. The volume of these trade activities plays a crucial role in understanding the economic health of a nation. Today, we will dive deeper into this subject. By examining the trade balance indicator, also known as the balance of trade, we can accurately gauge a country’s export and import levels.

Why are the import and export volumes of countries important to us?

For example, if we want to import a product from another country, we have to convert our country’s currency into the target country’s currency, and as a result we have to take our country’s money out of the country, If we import a lot into our country, the economy of our country will weaken and the amount of import will be more than the export.

But if we export a product from our country and send it to other countries, we get money from other countries into our country and our country’s economy becomes stronger. The trade balance index shows us the amount of import and export.

How a Positive Trade Balance Reported on Forex Factory Impacts Price on the Chart

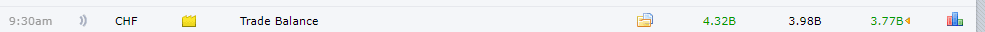

Now, let’s examine how a positive Trade Balance indicator reported on Forex Factory for a specific country can affect the price of the related currency pair, potentially lead to a price increase, and strengthen its upward trend.

Photo by Forex Factory

Photo by TradingView

Note the area marked in green, at this time the trade balance indicator has been published, which is higher than the previous value and the predicted value. And this causes the CHF currency to become stronger, and as a result, in our chart, the price of the CHF/JPY currency pair rises and rises.

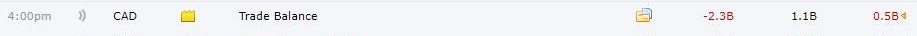

How a Negative Trade Balance Reported on Forex Factory Impacts Price on the Chart

But if the amount of published data is less than the previous amount and the predicted amount, our currency under consideration will weaken. If a country imports more than it exports, its trade balance is negative. If its exports are greater than its imports, its trade balance will be positive, and the demand for that country’s money will increase, making its currency stronger.

Photo from Forex Factory website

Photo by TradingView

Notice the image above, in our chart in the green box, when the Trade Balance indicator for the Canadian dollar was released and its value was lower than the predicted value, it caused the CAD/JPY trend to fall and move lower. At this point, we can make a good profit by opening a sell position. Before trading the market, always check the data and news so you can make a good fundamental analysis.

We hope you enjoyed this article.