Understanding How the Durable Goods Orders Index Influences Forex Market Trends and Volatility

Today, we are going to learn about one of the most important economic indicators and key news events in fundamental analysis. Fundamental analysis is crucial because it helps us analyze the economies of different countries. Economic news and central bank statements have a significant impact on the Forex market, causing price fluctuations. We use this information for our analysis and to make profitable trading decisions.

One of the important and influential economic indicators on the Forex market and market volatility is the Durable Goods Orders index. In this article, we will explain the impact of this indicator on the Forex market and price fluctuations. Additionally, we will review this indicator on the Forex Factory website to help you understand how its released figures create trading opportunities and cause price volatility in the market.

What are durable goods?

We consider durable goods to be those that last more than a few years, such as cars, appliances, washing machines, and telephones. Durable Goods Orders measure new purchase orders for these types of long-lasting products and serve as an important economic indicator.

The amount of purchases of these goods in a country’s economy can have a positive effect and ultimately make that country’s currency stronger. If the published value of this index was higher than the predicted value, our currency will become strong. If the value of this index is lower than the predicted value, our currency will become weaker and its price will fall.

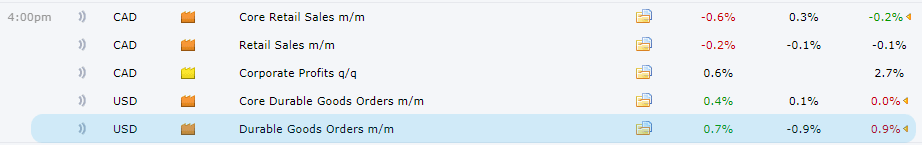

Photo by Forex Factory

As you can see in the photo above, the value of our Durable Goods Orders index is higher than the predicted value, and this news is strengthening the U.S. dollar.

Please note that if the published index value had been lower than the previous and predicted values, it could have weakened the U.S. dollar.

Photo by TradingView

In the picture above, we have marked the moment of the index publication with a green box on the chart. When the news is released and the value of our index is higher than the predicted value, it causes the price to rise on the chart. Note that we do not hold the trades opened on the news for a long time.

However, if the value of this index is negative or lower than the predicted value, it will cause the price on the chart to move down. At this point, we can open a sell position. If the index value is negative, foreign investors are unlikely to enter and invest in that country. This will weaken the country’s economy, and its currency will lose support, beginning a downward trend.

We hope this article was useful to you.