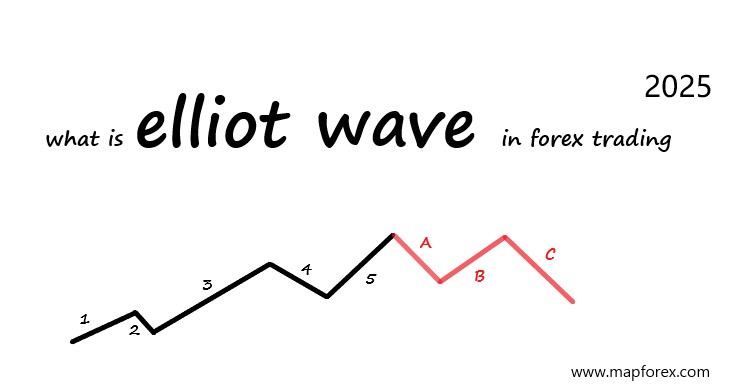

what is Elliott Wave in forex trading 2025

Today we would like to introduce you to one of the most popular methods of chart and market analysis called Elliott Waves. The Elliott Wave strategy is very popular among traders because it is very simple and convenient and it is considered to be a reliable strategy. We believe that a strategy should be simple so that we can use it well and enjoy it. The more complex and crowded your strategy is, the less you can focus on the analysis.

Major and corrective movements in Elliott Wave

Elliott waves include 2 types of movements, the main market trend and corrections, we use Elliott waves to find the main trend and corrections, and we can profit from market movements by identifying them.

In Elliott waves, the main trend has 5 waves and corrections have 3 waves, after the end of 5 waves, corrections occur in the market trend and after 3 corrections, the market continues its main trend again.

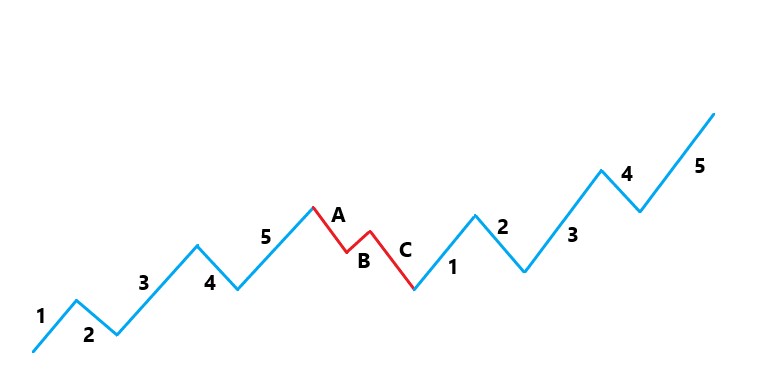

Look at the image above, the blue waves are the trend and the main movements that have 5 waves, in these waves wave number 3 is usually the biggest wave of the trend. After the 5 main waves the correction waves start. We call them A, B, C and they are red in the picture above. Learning Elliott Waves is very important to find trends and corrections in the chart.

In the picture above, in an upward trend, we found and checked the main trend and corrective trends of the market using Elliott waves, now we want to use Elliott waves in a downward trend.

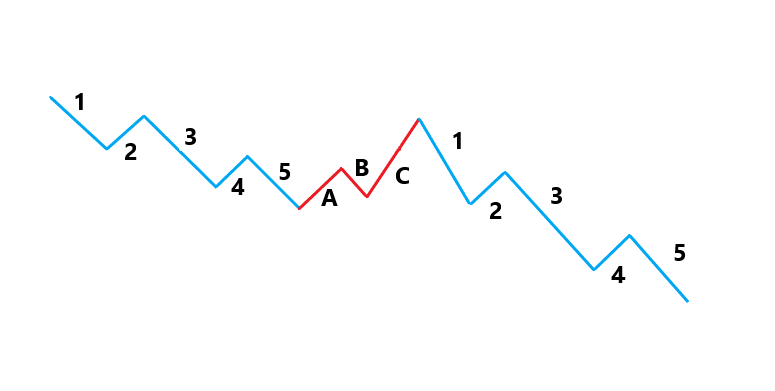

Elliott Wave in the downtrend

In the picture above we have shown you how to identify the main trends and corrective trends and how to find them using the Elliott wave in the downtrend. After 5 main moves, 3 corrective moves begin and then the market continues its downtrend with 5 moves.

We hope you enjoyed this article.