How to trade forex correlation?

Today we are going to talk about one of the most important forex topics and concepts that are very effective in your trades called correlation. The correlation can be either negative or positive. For example, if the Y currency pair moves similarly to the X currency pair, and when the price of the Y currency pair goes up, the price of the X currency pair also goes up, then the correlation between these 2 currency pairs is positive.

However, if the price of the Y currency pair goes down and the trend is downward, but the price of the X currency pair goes up and the trend is upward, it means that the correlation between these 2 currency pairs is negative.

How do I find the correlation of currency pairs?

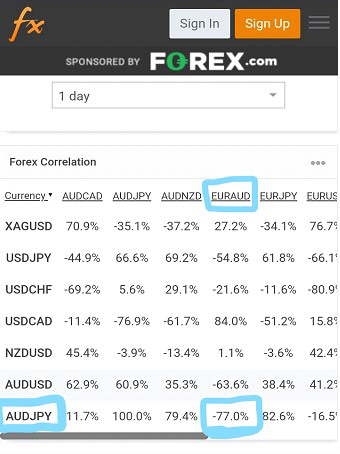

Myfxbook.com is one of the best sites where you can see the correlation of currency pairs. In the correlation section of the MyFX Book website you can see the correlation between Forex currency pairs.

For example, if 2 currency pairs have a correlation of -95, it means that they move against each other, but if the correlation is +90, it means that when one currency pair goes up, the other currency pair also goes up.

The higher the correlation number of 2 currency pairs, the stronger their correlation, whether negative or positive. One of the most popular and famous correlations is between the Dollar Index and the XAUUSD, which have a very strong negative correlation, meaning that when the DXY Index rises on the chart, the price of the XAUUSD falls at the same time.

Photo by myfxbook

Look at the image above, in the image above the correlation between the AUDJPY and ERUAUD currency pairs is negative and has a value of -77, which indicates a strong negative correlation.

This means that if the price of one of the currency pairs goes down, the price of the other currency pair is likely to go up at that moment.

We hope you found this article useful