Ascending Triangle Pattern in Forex 2025: Optimized Long-Trading Strategy & Entry Tips

Today we are going to talk about one of the most important trading patterns in Forex. This pattern is considered one of the most reliable and widely used formations, and trading it is usually very profitable. In most cases, this pattern is used for buy positions and is typically traded within bullish trends. The pattern we will focus on today is the Ascending Triangle. This classic formation carries relatively low risk but offers strong profit potential, which is why it has gained significant popularity among traders. Recognizing such patterns helps traders enter the market with greater confidence and avoid unnecessary risks.

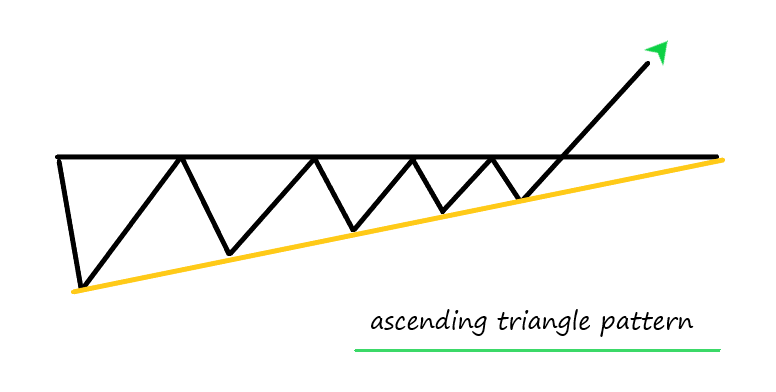

By learning and applying reliable patterns, we can execute trades more accurately and increase our chances of making profit. In this pattern, there is an upward trendline that acts as a support level and a horizontal resistance level forming the upper boundary. In this setup, the market creates higher lows, and each time the price reaches the resistance level, it makes a small pullback.

As the triangle completes, price movement becomes compressed and limited until the resistance is finally broken by a strong upward move. This is the ideal time to open a buy position and join the buyers. Such breakouts are often accompanied by an increase in trading volume, which further confirms the strength of the bullish move.

The image above shows an Ascending Triangle pattern. As you can see, this pattern is formed by a horizontal resistance level and an upward trendline that acts as our support zone. In this pattern, the price becomes more and more compressed until it suddenly breaks the resistance to the upside with a sharp move and then continues its upward movement and increases in price.

When is the best time to open a long position in this pattern?

The best entry point for a long position in this pattern is when the price has broken out of the triangle to the upside and formed a bullish confirmation candle. At this stage, we can enter a long position with greater confidence.

Photo By TradingView

In the example above, you can see a clear Ascending Triangle pattern on the chart, where the price becomes compressed and then breaks to the upside, continuing its upward movement. In this case, we entered a long position after the breakout of the pattern and the confirmation signal. This pattern usually appears during bullish trends and helps traders identify more reliable entry points for buying. That is why many traders consider it one of the most reliable continuation patterns.

We hope you enjoyed this article