Pending Orders in Forex Trading: Definition & Types (2025 Guide)

In this article, we will explore one of the most important methods in Forex trading, a practical approach that helps you manage your trades more efficiently and open positions without constantly watching the charts. It is quite difficult to spend all your time analyzing the market, especially when you also have other responsibilities and daily tasks to take care of. By learning and applying this method, you can trade more effectively while keeping a healthy balance in your everyday life.

Professional traders don’t spend the entire day sitting in front of charts. Instead, they analyze the market, decide on their strategy, and then set buy or sell orders at their preferred prices. When the market reaches those levels, the orders are automatically activated, allowing traders to continue with their daily routines without missing opportunities.

In Forex trading, there are four main types of pending orders. These tools are also widely used in other financial markets, such as cryptocurrency. They are designed to make trading simpler and more flexible. For example, you might complete your chart analysis and identify a price level where you want to open a position. However, instead of waiting for hours until the price gets there, you can simply place a pending order. Once the market reaches your desired level, the system will automatically execute the trade for you.

Types of pending orders in Forex trading

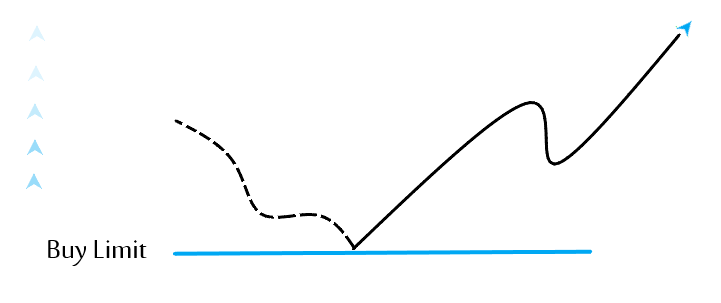

Buy Limit

In this type of order, the entry point is set below the current market price. We want to open a buy position at that specific level, but since the price has not yet reached our target area, we can place a Buy Limit order to let the trade activate automatically once the price touches it.

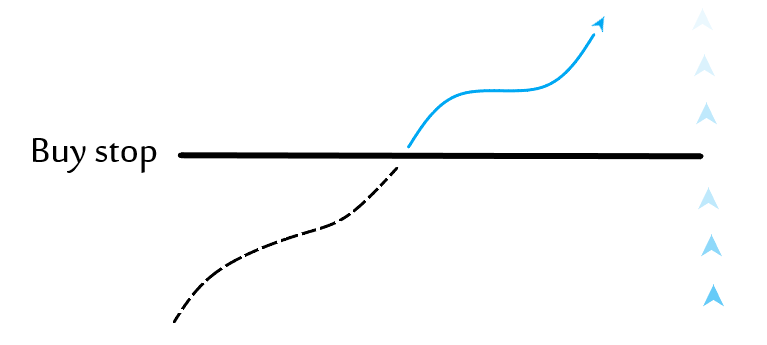

Buy Stop

In this type of order, the entry point is placed above the current market price. We want to open a buy position at that higher level, but since the market is still below our entry point, we can use a Buy Stop order. Once the price rises and reaches the specified area, the buy order will automatically be activated.

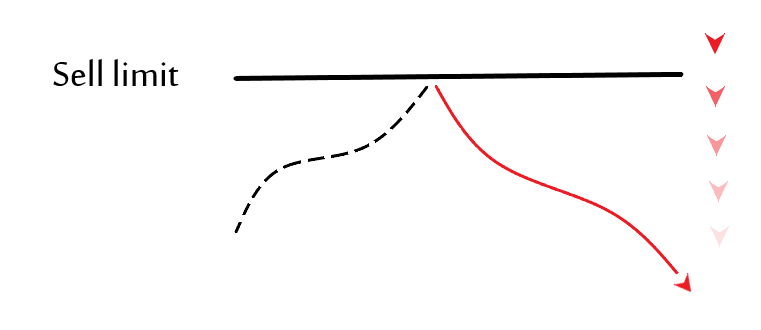

Sell Limit

In this type of order, the area where we want to open a sell position is above the current market price. We place a Sell Limit order so that when the price rises and reaches our desired level, the sell order will be activated. This type of order is often used when we expect the price to touch a resistance area and then reverse downward.

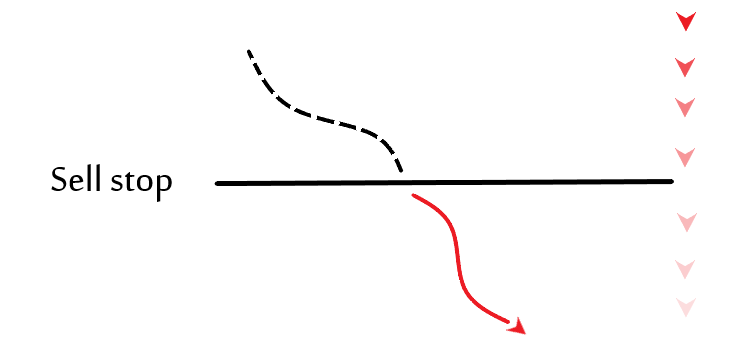

Sell Stop

In this type of order, the entry point for opening a sell position is placed below the current market price. We use a Sell Stop order so that when the market price drops and reaches our desired level, the sell order will automatically be activated. This order is commonly used when traders expect the price to break a support level and continue moving downward.

In this article, we have learned about the different types of pending orders and how to use each of them. By placing pending orders, we can confidently set the price levels where our positions will be opened automatically in the future. This way, we don’t have to worry about missing trading opportunities, because once the market reaches the price we set, our order will be executed without any further action from us.

We hope you have enjoyed reading this article.