What is PPI News in Forex Trading: How to Trade the Producer Price Index

Today in this article we are going to examine another important economic indicator that has a great impact on the Forex market in order to learn how to trade it. The index we are going to examine today is called the PPI. PPI is the summary of “Producer Price Indices” displayed in the Forex Factory as a summary.

The PPI index examines the final price of manufactured goods, for example, for a car factory, this index examines the final cost of producing cars.

And it shows us that the cost of producing products has decreased or increased compared to before. If the final cost of producing products in a country increases, it will cause inflation and increase the prices of products and goods in a country.

We found that the PPI index can affect the rate of inflation in a country. Also, the inflation rate and the PPI index affect the amount of interest rates that are issued and set by banks.

But how does the PPI index affect the interest rate ?

For example, if the published value of the PPI index is much higher than the previous value and the predicted value, it will cause inflation in that country to rise. And when inflation rises in a country, banks raise their interest rates to control inflation.

How do I trade the PPI index ?

If the value of the PPI index is higher than the previous value and its predicted value, it will strengthen our desired currency. On the other hand, if the value of the published PPI index is lower than the previous value and its predicted value, it will weaken our desired currency.

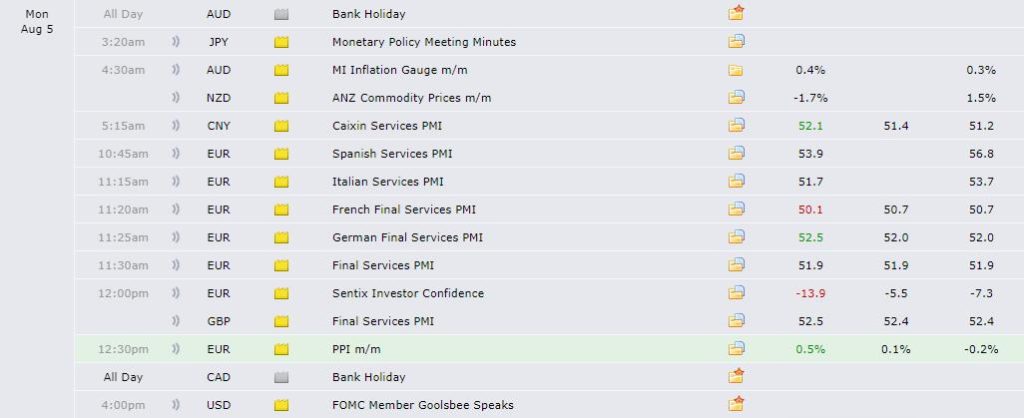

Photo by Forex Factory website

Pay attention to the photo above, as you can see, the value of the PPI index published on the euro currency is higher than the previous value and its predicted value, and this makes the EUR currency stronger.

Photo by Trading View

As you can see in the EURUSD chart, after the release of the economic news and the PPI index, the price has risen and you could profit from this price increase with the right fundamental analysis.

We hope you enjoyed this article.