Identifying strong and weak trends in forex

The first thing you should do in technical analysis is to identify the market cycles, because by finding the cycles you will know how and in which direction the market is going to move. After finding the cycles and the direction of the trend, you need to check the strength of the trend because the way you trade and your strategy depends on the strength of the trend. as you know, the way of trading and the strategy are completely different in strong, very strong and weak trends.

In this article we want to know the types of trends based on their strength and then learn how to trade each trend, stay with us.

Types of trends according to their strength:

1_ Very strong trend

2_Strong trend

3_ Medium-strength trends

4_ Weak trend

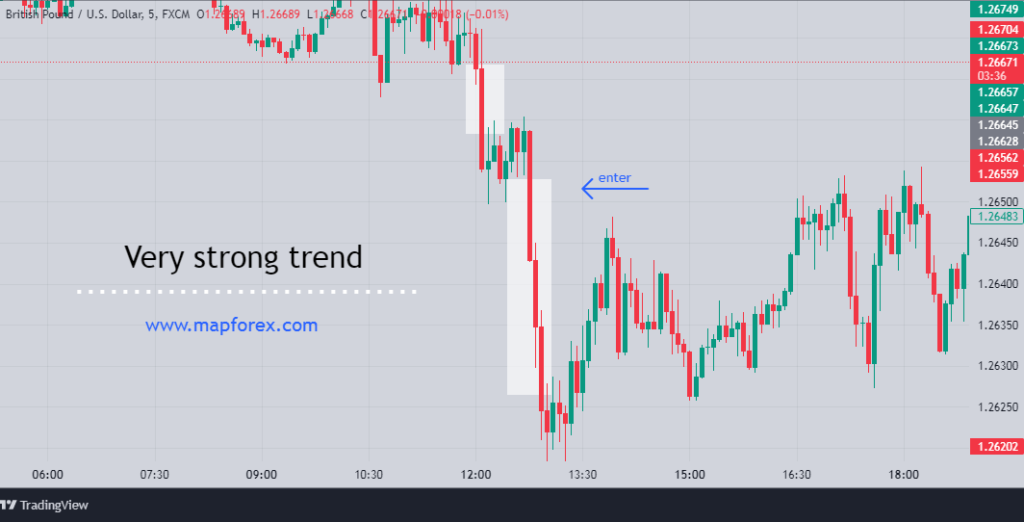

Very strong trends

Very strong trends such as spikes and breakouts move and their movements are fast and usually sharp and easy to see on the chart. note that in very strong trends you should only trade in the direction of the trend.

Photo from TradingView website

In the image above you can see a very strong trend that has moved down like a spike with sharp candles. to trade this type of trend, you can open your sell position when the trend breaks its previous low with a strong candle. We have also marked the entry point with an arrow in the picture above.

Strong trends

Strong trends form a nice trend line on the chart and we can easily identify them by drawing the trend line.strong trends usually have corrective movements or weak pullbacks.

Photo from TradingView website

In strong trends we can find support or resistance points by drawing the trend line and when the price hits the trend line we can open a suitable position. In the picture above we have marked the entry points with white arrows.

Medium-strength trends

In medium-strength trends, the price pulls back to the previous high or low, and after the pullback or corrective move, it resumes its main trend.

Photo from TradingView website

In this type of trend, it is recommended that you only trade in the direction of the trend, as the pullbacks and corrective movements are not as large.

Weak trend

In weak trends, the price moves with a slight slope and has large corrective movements, whether the trend is down or up. There are many buying and selling positions in these types of trends. This means that we can profit from both the rise and fall of the price, because the corrective movements are very large and we can open buying and selling positions in suitable situations.

Photo from TradingView website

Well, in the image above you can see a weak trend where we have marked the entry points for buying and selling positions with green and red arrows.

We hope you enjoyed this article.